Previous: First good snow of the year (4)

Morandi at the Met

Post #1266 • December 11, 2008, 12:55 PM • 52 Comments

Writing for the New Criterion this past October, Karen Wilkin repeated the wisdom among the admirers of Giorgio Morandi that he represents a kind of litmus test for visual sensitivity. Overtly, the paintings have nothing going for them. Upon examination, they reveal some of the most sophisticated handling of color since Cézanne. As artistic examples of the via negativa, they regard the spaces around objects as palpable, and the objects themselves as ephemeral. The results do something magical to scale: dusty bottles take on the blocky grandeur of Bolognese architecture, and the palettes evoke the creamy light of Emilia-Romagna despite having been painted indoors.

Speaking of the indoors, these paintings glow with interiority. The monastic life does not call to everyone, nor do its fruits, and I'm wondering whether the inclination to see value in Morandi's work has something to do with one's answer to this question: Does shutting yourself in a room and dealing with a single intractable problem appeal to you, or no? In any case, Morandi's monkish exploration of paint did not uncover a wide area, but the hole he dug went through to the core of the earth. Clearly, the figure pained him; two self-portraits show him agonizing his way around the painting, successfully, but in a manner that might have made another model's life impossible. The oversize works that we would expect from his mid-century contemporaries likely lay beyond his reach. But within this narrow problem of visuality, he has no equal. What champion marathoners can do with their legs, he could do with his attention. And as Simone Weil remarked, absolutely unmixed attention is prayer.

Nevertheless I see doubts about the work here and there. Skira produced the catalogue for this show, and it's a disaster. Whoever was responsible for color correction found these paintings too drab for their liking. I can't help but think that it was performed by someone calibrated to the work of Takashi Murakami, yanking the saturation slider in Photoshop as far to the right as they could get away with. Even the images supplied to your author look acidic in places and I'm posting only the better examples. At this point we've likely all heard someone opine that perhaps the current economic downturn will oblige us to measure our success with more wholesome and humble metrics than our bank balances. I similarly call upon the doubters to measure the success of Morandi's work with metrics other than intensity. They require a visual equivalent of listening. But in turn they yield a visual equivalent of revelation.

Giorgio Morandi: Still Life, 1916, oil on canvas, 82.5 x 57.5 cm, The Museum of Modern Art, New York, acquired through the Lillie P. Bliss Bequest, 1949, © 2008, digital image, The Museum of Modern Art, New York / Scala, Firenze © Giorgio Morandi by SIAE 2008

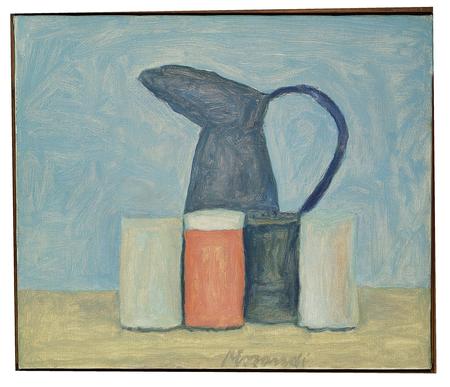

Giorgio Morandi: Still Life, 1949, oil on canvas, 36 x 43.7 cm, The Museum of Modern Art, New York, James Thrall Soby Bequest, 1979, © 2008, digital image, The Museum of Modern Art, New York / Scala, Firenze, © Giorgio Morandi by SIAE 2008

Giorgio Morandi: Natura morta, 1941, oil on canvas, 30.2 x 44.6 cm, Courtesy of Eni, © Giorgio Morandi by SIAE 2008

Giorgio Morandi: Natura morta, 1943, oil on canvas, 25 x 30 cm (60 x 68.6 cm framed), private collection, Crevalcore, Italy, photo © Luciano Calzolari, Crevalcore, © Giorgio Morandi by SIAE 2008

Giorgio Morandi: Still Life, 1956, oil on canvas, 25.2 x 35.2 x 1.9 cm, Yale University Art Gallery, Gift of Mr. and Mrs. Paul Mellon, B.A. 1929, © Giorgio Morandi by SIAE 2008

Giorgio Morandi: Still Life, 1943, oil on canvas, 30 x 45 cm, National Gallery of Art, Washington, Collection of Mr. and Mrs. Paul Mellon, 2006.128.29, photo: Edward Owen, © Giorgio Morandi by SIAE 2008

Giorgio Morandi: Still Life, 1953, oil on canvas, 20.32 x 40.32 cm, Washington, D.C., The Phillips Collection, © Giorgio Morandi by SIAE 2008

Giorgio Morandi: Natura morta, 1954, oil on canvas, 26 x 70 cm, Mart, Museo d’Arte Moderna e Contemporanea di Trento e Rovereto, Collezione Augusto e Francesca Giovanardi, Archivio fotografico Mart, © Giorgio Morandi by SIAE 2008

Giorgio Morandi: Natura morta, 1956, oil on canvas, 30 x 45 cm, Bologna, Museo Morandi, © Giorgio Morandi by SIAE 2008

Giorgio Morandi: Natura morta, 1962, watercolor on paper, 16 x 21 cm, Bologna, Museo Morandi, © Giorgio Morandi by SIAE 2008

Giorgio Morandi: Natura morta, 1961, oil on canvas, 25 x 30 cm, Bologna, Museo Morandi, © Giorgio Morandi by SIAE 2008

2.

December 11, 2008, 2:03 PM

I'm afraid these reproductions are against the law. I will alert the FBI, though they're kind of busy at the moment in Illinois.

3.

December 11, 2008, 3:49 PM

While a few, rare artists can do great work in disparate media, formats and genre, that is clearly not the norm, or rather, not normal. Greatness in even one distinct, finite area is hard enough to come by. True, Morandi was very specialized, obviously much too specialized for some tastes, but that's certainly preferable to being a jack of all trades but master of none.

We tend to forget that overt specialization, such as in a certain kind of subject matter, like animals or still life, was long perfectly accepted and even expected. There is a logic to this approach, as it is quite well established that being extremely good at doing one thing does not necessarily carry over to doing anything else.

Sometimes there are technical limitations, other times temperamental ones, sometimes both. It's not always a matter of desire or interest on the artist's part; he or she may desperately want to do a certain kind of work but simply can't pull it off. Conversely, sometimes artists foolishly disdain what they can do superlatively well, forever chasing after what they will never attain.

The key, then, is to be keenly aware and accepting of both assets and limitations, and act accordingly. This includes, of course, being true to one's own nature or character as well as one's particular talents. The best results are always based on optimal, maximal use of what is actually there (as opposed to what the artist wishes were there) and prudent avoidance or minimizing of what he or she is not naturally suited for. Morandi obviously knew what he had to work with and kept very much to that. He was right, and the results fully justify his "narrowness."

4.

December 11, 2008, 4:22 PM

I have never been that wild about Morandi. He was a competent, careful painter. (When he wasn't creful, as in Natura Morta, 1943, things declined. That picture divides in the middle, then pinwheels, color is somewhat felt, though ... but the signature is awful.) I can't mention him in the same breath as Cezanne, not out loud, anyway. Dots on the screen ... I guess I can because I just did.

5.

December 11, 2008, 6:21 PM

I don't think Morandi is in Cezanne's league either. But my relationship with painting requires delight at any cost.

It may sound corny, or forced, but Morandi is like a wonderful chocolate dessert rather than a great main course. When I am enjoying a Morandi I am not thinking of Cezanne, I am enjoying the Morandi.

When something is good you enjpoy it, that's all.

6.

December 11, 2008, 7:18 PM

rightfully, i don't think franklin was putting morandi in the same league as cezanne. he was just mentioning the "color handling". but if you want to compare color (handling), i'd compare him more to degas than cezanne. it is that pastel color thing. and then later wayne thibaud seems to have sprung out of morandi with a little POP.

all the classically styled pics here, which excludes the 1916 and natura pics, seem to be quite fine little gems.

7.

December 11, 2008, 8:08 PM

Beautifully written Franklin. A customer of mine recently told me "We went down to New York. We saw a show at the Met. It was bottles and things" he said with a confused look and as close to a sneer as a retired, polite, retired banker could muster. I just smiled and said "Oh Morandi, he's kind of a painter's painter". I wish I had read your review. Cezanne has more angst, don't you think? Could you say angst about Cezanne? -A greater struggle? I'm a man of no importance, what do I know? But I see a kind of angst in Cezanne. Always have.

8.

December 11, 2008, 8:27 PM

Karen Wilkin, mentioned in Franklin's post, wrote "The Secret Life of Painting" about Bruno Fonseca, Caio's older brother who died of aids. Has anyone read that? I just discovered it on a remainders table at the RISD bookstore.

9.

December 11, 2008, 11:13 PM

David, re Ceznne's angst:

http://korotonomedya2.googlepages.com/Merleau-Ponty_-_Cezanne_s_Doubt.pdf

10.

December 11, 2008, 11:26 PM

David, thank you, and I want to thank you for the invitation down to your part of Mass, which I am trying to find on one of these recent threads and I'm not having much look. Could somebody get me an assist?

11.

December 11, 2008, 11:27 PM

Make that luck. In fact, let's make it bedtime.

12.

December 12, 2008, 6:16 AM

Opie, thanks. I did read "Cezanne's Doubt" 25 years ago, and could never get it out of my mind. I know this is a sophisticated flash mob, so I assumed you'd all know the reference, but I was also interested to know how the impression has held up among the cognoscenti.

I know I mentioned somewhere that I just read L. Weschler's True to Life, which begins with Robert Irwin, has a load of David Hockney in the middle, and then ends again with Irwin - which I found fascinating. I'll give away the ending, since it's an art book: Hockney and Weschler are discussing H's large, multi-paneled paintings of trees in the English countryside. Hockney: "I've taken to thinking of these paintings as figure paintings". Weschler: "but they're landscapes". Hockney (waits 2 beats): " Ah, but you're the figure".

Maybe I'm forcing it, but I find an interesting arc from those apples of Cezanne through Irwin's Getty Garden, to Hockney's trees (and an aside with Franklin looking at Morandi).

Franklin, e-mail we anytime. The Richard Winther show is on till Jan. 15 at U. Mass.

13.

December 12, 2008, 10:16 AM

Your arc may have something to it, David, but my problem is I find Irwins work weakly theatrical at best and Hockney's recent work outright bad.

14.

December 12, 2008, 10:30 AM

I know. It's the old struggle between the head and the eye. The heart is in there somewhere too. It may be for another artist to take this arc to a better place. It may just be Hockney's devotion to painting I like. I could argue more about what I see in both artists, but have to run.

15.

December 12, 2008, 10:43 AM

Well, as long as the head follows the eye, we're OK. Without the eye, the head is blind.

16.

December 12, 2008, 1:18 PM

Vision is overrated, at least if you've never seen all that clearly to begin with, or can't make anything really worth seeing. Hence the alternatives, such as they are.

17.

December 12, 2008, 8:29 PM

Great post Franklin.

Enjoyed reading it, and your inclusion of reproductions of his work.

Morandi's paintings can transform for me into surrealist theater at times: See de Chirico

See also Piero della Francesca,

who they all studied.

18.

December 12, 2008, 10:06 PM

Marc, you're right about de Chirico -- some earlier Morandis definitely looked like a more rigorous, cleaner de Chirico. I liked those better. Franklin didn't. He said Morandi's heart clearly wasn't in it. Maybe it wasn't, but I like that kind of minimal, smooth design.

I wanted to mention, because Franklin won't, one small anecdote from when we were there. Franklin was stopping here and there to sketch and two women from Philadelphia (he mentioned them earlier) saw his Kuretake brush pen, so to demonstrate he turned back in his sketchbook a few pages.

"Hey, that looks familiar!" one of the women said, pointing to a drawing. It looked familiar to me, too, because Franklin had scanned and posted it last week. "Rouault!"

I don't remember Franklin's exact words at that point, but they were the equivalent of "TOUCHDOWN!"

19.

December 13, 2008, 11:20 AM

I will always enjoy Morandi's work. It all just seems so wrong, it is an aquired taste. It is the visual equivilant to listening to Trout Mask Replica.

Cezanne is easy to enjoy, too beautiful.

Morandi is difficult to enjoy, but worth the effort.

I see a future Phillip Guston is some of these works.

20.

December 13, 2008, 11:41 AM

I bought "Safe As Milk". I listened to it a few times and tried to like it. I failed. It had its moments, but they were separated by vast gulfs of abject weirdness.

Morandi's not quite like that. I can see how someone could find a lot to like in Morandi. Just not me.

21.

December 13, 2008, 12:26 PM

I don't find Morandi difficult to enjoy. Nor do I find Cezanne too beautiful.

22.

December 13, 2008, 2:22 PM

"Too beautiful" all by itself is a silly statement. It needs a context. I don't think anything can be too beautiful. But something can be too beautiful for a certain purpose. Like on "Law & Order: SVU," the new ADA on the show is too damned beautiful. First, no lawyer on Earth is that beautiful. Second, I can't pay attention to the story when she's onscreen because all I hear is "I'm so beautiful! Look at me! I'm so beautiful!"

Since the purpose of art is to have no purpose other than to be looked at, I can't imagine how any work of art can be too beautiful at all.

23.

December 13, 2008, 2:42 PM

I want too beautiful for Christmas. I can take it.

Interesting that Cezanne can be too beautiful now. Rumor has it that in 1900 they were thought to be pretty godawful looking.

Don't get discouraged, Arrow. We pick on everything around here.

24.

December 13, 2008, 4:07 PM

Opie, would that be "too beautiful ADA" or "too beautiful Cezanne"?

Apparently it doesn't matter what you are accusing Cezanne of, as long as it is something.

25.

December 13, 2008, 5:04 PM

Americans for Democratic Action??

28.

December 13, 2008, 6:44 PM

I love the Captain Beefheart reference. I don't quite get it, but I love it. Try downloading a list of the good Captain's song titles and compare them with Jenny Holzer's projections at the Guggenheim. "Gimme That Harp Boy", "Moonlight in Vermont", sublime, and he's a painter, maybe that's the connection.

http://www.freewebs.com/teejo/lyrics/lyrics.html

http://www.artnet.com/artist/17294/don-van-vliet.html

29.

December 13, 2008, 7:07 PM

Well, I am not up on Capt Beefheart or ADA or whatever that's all about..

I just meant "too beautiful" as an immanent essence, the etherial quality of too beautiful drifting down and permeating my environment.

30.

December 13, 2008, 7:19 PM

How nice for you Opie. (I'm being sincere, no sarcasm at all intended).We could all use a little of that now and then.

31.

December 13, 2008, 7:21 PM

OK, sorry I wasn't paying attnetion. The Law & order ref from Chris.

Anyway, Bill O'Reilly has a bevy of beautiful female lawyers on his show, if your liberal hearts can stand to check it out.

32.

December 14, 2008, 11:54 AM

with all markets pretty well thrashed, where would the resident investment pundits be putting money with say a 1,5 and 10 year time horizon?

options include but are not limited to stocks (entire markets, sector specific, individual companies and foreign or domestic), bonds, real estate (location), art or other collectibles, natural resources (energy, oil/gas, precious metals, etc.) or cold cash.

33.

December 14, 2008, 12:37 PM

Hi 1. It is about time to short bonds. The easiest way to do that is to buy an ETF named TBT. It goes up when bonds go down, and is leveraged so it goes up faster than bonds go down (when interest rates increase the value of bonds goes down for purposes of TBT). Rising interest rates may benefit the dollar, if you want to trade it directly. There may be an ETF that trades the dollar for you.

Stocks that benefit from rising oil prices should do well for a while too - now that $25 dollar oil has been predicted. But there is still a significant undertow operating in the market that, opposite of the high tide that floats a lot of boats, grounds many boats. Whatever, look for companies that have zero and I mean zero debt. Debt has not been fully discounted because debt is not yet understood by the markets, much less the government.

Cash is being destroyed - deflation. Thus precious metals, which do well in inflation, don't look so hot for the time being. Cash, on the other hand, is king. Conserve all you can. You will be able to buy more house with it, more car with it, more of a lot of things with it next year. And you will probably be able to buy more shares with it then too.

Deflation and debt are a problem for the whole world.

In general, most markets are being drawn down, so going long fights the trend. On the other hand, going short pits you against governments, which have become quite inventive lately with their interventions. It is not easy to make money on either side. Like I said, we are in deflation and money is disappearing. Making a profit is like chasing a ghost.

10 years from now the bear market will probably be over, so there will be a lot of opportunities, if you have any assets left. Meantime, "buy and hold" has been replaced with "hold and fold".

34.

December 14, 2008, 1:14 PM

John, are you shorting bonds because rates can't get much lower?

My advice is put all your money in the safest cash equivalent you can find. The universal attitude right now is "my investmewnts are down so much I don't even look". This will change in time, when the mantra becomes "I had to save at least some of my investment so I sold". That is called "panic",.

Until that happoens I don't thing any investment is wise, unless you really are a good trader. A good trader can make lots of money in this market because it is so volatile.

35.

December 14, 2008, 1:29 PM

Thuis will explain ETF and TBt somewhat

http://seekingalpha.com/article/108903-bond-bubble-coming-to-an-end-prepare-for-the-bust

36.

December 14, 2008, 1:35 PM

I love how a discussion on Morandi can morph into a financial investment advice session here. It's why I read this instead of, say, PainterNYC.

37.

December 14, 2008, 1:41 PM

John, do you think the TBTs may be affected after the first of the yer because funds are buying bonds now as end-of-year window dressing? That is, will they shoot up after the first of Jan when the funds are through buying bonds?

38.

December 14, 2008, 2:23 PM

I have a "funny money" account that I funded with money I was willing to completely lose. I started trading it last March. It is up about 150% by trading options on indexes. It has not been easy and I don't consider 150% in options to be "lots of money". It requires a lot of attention on some days, and If I am unable to give it the attention it needs, I can lose. One day, an hour before the close I was up 30% on the trade as I had been all day so I decided to run an errand and wait until the next day to consider whether to close or keep it. When I returned home the damn thing was down 30%. Volatility is not exactly a great friend. A few more mistakes like that one and the whole 150% could be wiped out.

There are a lot of ways to analyze bonds technically. Most of them say they are at the end of a runup. One guru has analyzed that a certain spread predicts a 21% possibility that treasuries themselves will fail (it is more a case, I think, that these markets are treating treasuries as if there is significant risk that their value will go down - that is, interest rates will increase).

Fundamentally: Even though assets are mostly deflating now, the government's penchant for floating massive debt to finance bailouts the likes of which we have never seen before should eventually cause inflation. Typically interest rates go up in inflation. Those who buy the bonds (extend credit to the government) will not pay as much for the bond because they will want more return and hence the coupons expand as the bonds contract and effective interest rates go up. The bond market, like the stock market, tends to discount the future, so this can happen before actual inflation kicks in.

Corporate debt, as far as I am concerned, is a mess and I will stay away from it, no matter how high the yields go.

But notice I said it is "about time" to short treasuries (and I mean the long term variety), not that now is exactly that time. I have not bought any TBT. I'm watching them. Rates can stay low and go lower for quite some time. Only when there is a pattern of higher highs and higher lows in interest rates will it be remotely safe to invest in a leveraged short the bond fund. But 1 was asking about ways to make money in this environment, and I think that shorting long treasuries is one way. Don't bet the farm on it though. The government is perfectly capable of intervening there too if it does not like what develops.

We don't use real money anymore. It is called fiat currency instead. Guess whose fiat it is ...

For the most part, the wisest thing is to conserve cash. The bargains will come if you live long enough. Until then, live frugally.

39.

December 14, 2008, 2:37 PM

Good thoughts John,

I'll add, that selling Euros may be a good trade for the next year or so. The Euro/USD pair recently broke out of a range to the upside. But I consider this to be a false move and they may see parity within that time frame. You could do this synthetically by shorting an ETF called FXE. Not sure if you are into technical analysis or not but here is my projected target. It really depends, as John points out, how much government intervention we see. On the other hand, companies will do what they need to do with regards to forward contracts, and that will affect the spot market in a big way. The government's roll may be somewhat exaggerated.

Longer term, 5-20 years: We just saw the stock market endure the opening salvos of a cyclical bear market. So put another way, if history is any guide, the next 12-36 months may offer some of the best investment opportunities of our lives. Although I do not feel this market has truly bottomed yet, far from it actually. I will be on the look out, for decent risk/reward set ups within that time frame. Before this happens however, I'll need to see a lot more despair. According to our government, this country still employs over 93% of its population! Once we are down to around 75-85% the risk/reward ratio to go long stocks will be much better. On that cheery note, Marry Christmas everyone!

40.

December 14, 2008, 2:38 PM

Opie (#37): I sort of answered this in 38. But to put it briefly, the risk in buying bonds is that interest rates will go up. When the supply of bonds increases too fast, there are not enough investors to chase them and the price goes down. The threat isn't so much "window dressing" as the so called "fiscally conservative" administration's unprecedented taste to shove billions and billions of them at the market. I expect the Obama administration to set even larger new precedents, making Bush seem less radical than he does not.

Except for a few senators and congressmen, they are all acting like democrats when it comes to raw spending and republicans when it comes to making the world safe for rich people by giving all that money to help those who already have more than their fair share. Very strange to me.

I was very amused when Dodd said he dreaded seeing what the stock market would do Friday because his bailout for the automakers was blocked. I thought, the market will never allow itself to become the pawn of politicians and sure enough it went up.

Not that I know what to do. I can only say that we stuck our finger into the bailout tar-baby and now we are in up to our eyeballs, with respect to this bailout thing. Perhaps there is life inside a black hole as some physicists have suggested. The Japanese have lived in a depression for a long time and I've heard some of them ask why we are so worried about it.

41.

December 14, 2008, 2:45 PM

Suze Orman, who is a lot wiser than most gurus give her credit for, says we are in a secular bear that began in 2000. The good news, then, is that we have 8 years of it behind us. Secular bears last on average 15 years, so 8 down, 7 more to go.

42.

December 14, 2008, 2:59 PM

I should add, that on the above chart, if a Christmas type rally gets a full head of steam even up to or after inauguration day, this ETF could easily retrace to the 50 or 32% lines on the fibs. That equates roughly to 142-146. At that point, it would be a low risk short from my point of view.

43.

December 14, 2008, 3:27 PM

in the short term i think the small cap or micro cap january effect play is likely a winner.

based on the charts the bonds do look very overextended.

and if oil gets close to 35 or even under 40, i don't see how it could not be a buy.

44.

December 14, 2008, 4:15 PM

John #38 & #40 I understand the dynamics. I was curious about the timing. there are a lot of mixed pressuresd on bonds which change with the environment. Fear and window dressing are two reasons for the high price right now. In the near-term future the funds lightening up on bonds and the fed raising massive amounts of money may push the value down. Do you think that sounds like a good buy/sell scenario?

45.

December 14, 2008, 4:34 PM

There is no question that an overly large supply will be brought to market for sometime. That tends to increase interest rates.

There is no question that investors are willing to pay up in order to lessen their fear. That decreases interest rates.

There is no question that investors have been paying more than ever to lessen their fear. There is a question as to how long they will continue to do this. When they quit, that will also increase interest rates. I think that is coming soon. But don't as me to name the day. Again, look for higher highs and higher lows in rates. That is a sign of a reversal of the current trend.

Don't bet too much on it, though. This is not a market for widows, orphans, or sane people.

46.

December 14, 2008, 7:16 PM

I guess I will just hold on to my 79% safe treasuries.

47.

December 14, 2008, 7:37 PM

I bought gold a couple of weeks ago when it hit $742 and it's up at $827. Certain libertarian economists are looking at a potential injection of $7.5 trillion into the economy, when the GDP is $14.3 trillion, as a massive inflation that will put gold at $1500. I'd invest some more but right now I'm trying to work on a more fundamental problem of creating an income stream. :P

I guess I should add here, as the producer of Artblog.net, that I am not a financial advisor and if you take any recommendations given in these pages you deserve whatever misfortune befalls you.

48.

December 14, 2008, 11:05 PM

In the words of David Sedaris' brother, 'The Rooster': "Fuck the stock talk, hoss, I ain’t investing in shit."

49.

December 15, 2008, 9:04 AM

I read that shit is trading at a five-year high.

51.

December 15, 2008, 6:34 PM

Looks like the NASDAQ in 2000.

52.

December 15, 2008, 7:03 PM

I know, I never thought I would see this in the bond market. Unreal.

1.

MC

December 11, 2008, 1:57 PM

Hmm... you could crop a few tiny Sean Scully paintings out of some of these...